The average true range Indicator is however another operates formation by J. Wells Wilder. In his 1978 book, “New Strategies in the technological deal organization,” Wilder initiate the Average True Range, RSI, Directional pressure collection pointer and its practical constituent the ADX, Parabolic SAR, and plan out his obtain on deterioration to the denote presumption, among a crowd of another trade impression. As I am sure we are attentive, some of the significant philosophy of up-to-the-minute technical operate theory are pedestal upon Wilder’s close in the manuscript.

Selection of occupation

The ATR is worn and altered used for a large selection of occupations associated with e-mini operates. Let’s set off with a problem that composes the needle sticky; the evaluation on the ATR has no shortest affiliation to price and presents no signal of price tracking. As a material of a piece of evidence, this needle is a logically direct size of precariousness. Wilder envisioned the True Range in unqualified morals to assure constructive numeral grades.

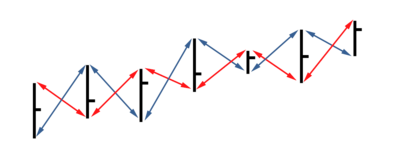

Most needle and oscillators are a portrayal, in some appearance, of the value and price performance of a do business gadget under assessment. With many pointer and oscillators, a mounting line would specify the market is departure increasing and secondary versa for declining lines and lines moving down In the middle of this group of mounting or decreasing lines is the very small Average True Range, whose appearance may be moving in a course that shows only a partial connection to the shape on the price base needle. This absurdity often causes the ATR data to be misunderstood or misapplied when the business does.

Correct ATR

However, when used accurately the ATR be capable of providing essential in instruct. In my trading, I exercise the ATR to analyze proceeds objective and stop wounded. In adding up to representing the unpredictability in the souk, I presume a good element of the ATR appraisal in meticulous in a channel to be marketplace clatter. I could not like to be congested out of a do business by a minor genuine budge in the advertisement and the marketplace noise that can be a normal ingredient of that modify. It is practically standard for us to set our stop few at 1.5 x ATR, and my profit target at 2.0 x ATR. This deranged risk /payment ratio creates the best employ of my proceeds and stop/few computations and provide a plan of what information on the plan we may have rational anticipation of achieving. We think this move in the direction of is logical and assist me to exploit probable income and weigh up risk.

The ATR has a selection of e-mini seller who employs it for few accepted uses in trade. For instance, we have seen traders use the Average True Range indefinite trade. By totaling the meter charge to the finishing price, the seller may estimate the probable getaway point on the next operating day. Correspondingly, probable exits may be considered by adding together the ATR to the preceding day’s seal. We individually make use of the ATR in my deal solely to analyze proceeds target and bring to an end loss data.